** “

In today’s market, cryptocurrency is developing rapidly, traders and investors are constantly wanting to maximize profits and as little loss as possible. One strategy that has received a lot of attention is a brief position when the merchant bet on the property hoping to earn from the fall of his price. In this article, we will explore the Uniswap (Uniswap (Uni) short -term sales concept, a popular decentralized exchange (DEX) built on Ethereum Blockchain and Explore Pith Network (PYTH) as a possible reduction in market instability.

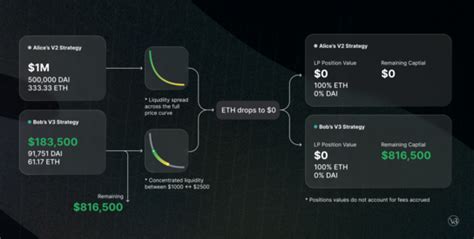

UNISWAP Un: DEX on liquidity and efficiency

Uniswap is undoubtedly a pioneer of the financial space, allowing consumers to trade chips due to several exchange with minimal skating and maximum efficiency. Started in 2017, Uniswap became one of the most popular Ethereum Blockchain Dexes, from 2023. March – Over $ 20 billion – the total lock value (TVL). The decentralized platform architecture ensures that the transactions are safe, transparent and invalid, making it an attractive choice for traders who want to manage risk effects.

Short position: high -risk strategy

Traders can take a short position in Unniswap by borrowing or borrowing property in the hope of selling them at a lower price and buying at a higher price. This strategy is often used during the fall of the market because traders seek to profit from the fall of real estate prices. However, short sales are at high risk including:

1

2.

PYTH Network (PYTH): A possible reduction in market volatility

Pyth Network is a decentralized financial protocol that uses Ethereum Blockchain to create ecosystems to define programs to the community. One of its main features is Pyth’s native access key, which is a useful network access key. In recent months, Pyth has acquired a major cravings led by use in cases of use such as:

1

2.

Maintenance of market markets Pythu

Pytha potential, as a reduction in market volatility, can be attributed to cases of its use and basic technologies. By providing a decentralized loan mechanism, PYTH allows traders to control the risk more efficiently by reducing the likelihood of significant losses during the market fall. In addition, the Pyth platform for the creation of the Stabular is possible by creating an asset that is less related to traditional property, which is why they are a sustainable alternative to merchants seeking diversification.

Conclusion

The short sale of Uniswap Uni is a high -risk strategy that requires careful consideration of risk management methods to prevent significant losses. However, the Pyth Network (PYTH) offers a possible facilitation of market volatility through the decentralized loan mechanism and platform for stable creation. Understanding the concept of short -term sales and alternative strategies such as Pyth, traders can acquire a valuable insight into the cryptocurrency market and make reasonable decisions on their investment portfolio.