Market volume attraction: The main strategy of cryptocurrency investments

The cryptocurrency world has undergone a meteorical growth in recent years, and prices are rising rapidly and investors are demanding engaging. However, investing in cryptocurrencies can be a frightening task, especially for those new to the market. One of the most effective ways to reduce the risk and increase potential return is market volume.

What is market volume?

Market volumes refer to the total amount of trade activity in a specified cryptocurrency market. This includes a variety of factors such as buying and selling volume, trade couples and liquidity levels. By analyzing these values, investors can gain valuable insight into the market mood, trends and possible price movements.

How can market volumes help investment strategies?

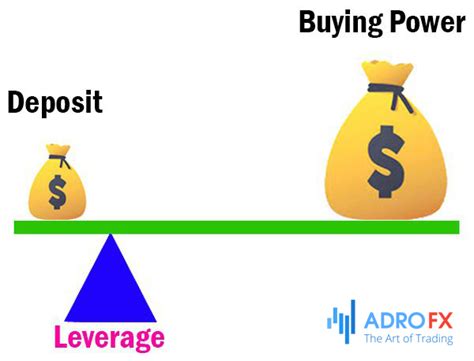

Marketing is an innovative approach that allows investors to reinforce their transactions without requiring large initial capital investments. Here are some ways of market volumes can help:

1

Risk Management : By attracting market volumes, investors can set up suspension orders or position limitations by limiting potential losses in the event of a significant price fall.

- Increased potential returns : Market volumes often coincide with high pressure trading sessions, where liquidity and interest purchase overvoltage. It creates an environment that promotes higher price movements and increases the return on those who invest in these periods.

3

Market Mood Analysis : By analyzing market volumes, investors can identify trends and mood shift in the cryptocurrency market. This allows them to adjust their strategies accordingly and make more informed investment decisions.

- Scalability : Market attracting makes investors more effective in increasing their transactions through less capital, while gaining considerable benefits.

Popular market volume strategies

Here are some popular strategies that use market volumes:

1

Long/short schemes : Investors use market volume data to identify excessively combat or sold areas in the cryptocurrency market. When selling these areas and buying prices, the goal of investors is to benefit from increased volatility.

- Trend The following : This strategy involves identifying and reducing supply (sale) models in a specified cryptocurrency market. By following the extremes of these trends, investors can benefit from possible price movements.

3

Range Trade : Range trade involves buying and selling cryptocurrencies in certain price ranges using its associated volatility.

Market volume tackle tools and technologies

Investors rely on various tools and technologies to use market volume power:

1

Cryptocurrency Stock Exchange : Online stock exchanges such as Binance, Coinbase and Kraken provide liquidity and market data, allowing investors to analyze and optimize their strategies.

- Volume Analysis Tools : Specialized software such as Cingecko, Cryptocompare and Tradingview offers real -time market volume data and diagram design tools.

3

Algorithmic Trade Platforms : Platforms such as Tradingview, Ninjatrader and Quantopian provide improved trade algorithms and analysis opportunities to help investors execute their strategies.

Conclusion

Market volume attracting is a powerful tool for cryptocurrency investors who want to increase potential returns and manage the risk. By analyzing market data, investors can get insight into trends, mood shifts and price movements, allowing them to make more informed investment decisions. Regardless of whether you are an experienced investor or a new world of cryptocurrencies, market strategies with market volumes are a great starting point for success.