Cryptocurrency rise and influence of open interest on futures trafficking

When the world of finance is constantly evolving, there are new markets that have the potential to disrupt traditional business methods. One such market is an increase in cryptomen. Thanks to their decentralized and borderline nature, cryptocurrencies have attracted great monitoring among investors looking for alternative investment opportunities.

One of the key aspects of the cryptocurrency investment is futures trading. Although this may seem like a foreign concept for those who are not familiar with these markets, understanding the concept of open interest in trading futures can provide valuable information on the world of investment of cryptocurrency.

What is open interest?

Open interest applies to the number of unpaid contracts that merchants or investors have. In other words, it measures the total number of contracts that have been purchased and sold at a particular period. The more contracts that are open on the stock exchange, the higher the interest is probably open.

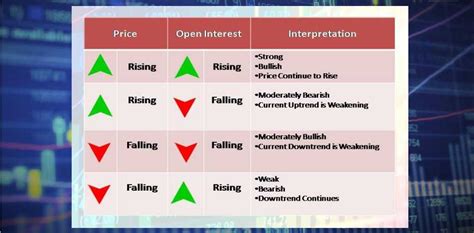

When trading in futures, open interest can provide several key knowledge about market sentiment and business. For example::

* Increased open interest : The increase in open interest may indicate a strong demand for a particular cryptocurrency or asset class, which potentially leads to an increase in prices.

* Reduced open interest : On the contrary, a reduced open interest may indicate the sold conditions or bear sentiment, which could lead to lower prices.

* Movements in market sentiment : Changes in open interest can also signal changes in market sentiment. For example, an increase in open interest may indicate that investors are becoming more optimistic about the prospects of a particular cryptocurrency.

The relationship between open interest and cryptomen prices

An open interest plays an essential role in the cryptocurrencies. Higher open interest usually suggests a stronger demand for a particular cryptomenia or asset class, which can lead to higher prices. On the contrary, reduced open interest may indicate weaker demand, leading to lower prices.

Here are a few key points that need to be considered in terms of the relationship between open interest and cryptocurrency prices:

* The relationship between open interest and price movements : a strong increase in open interest is usually associated with a bull trend, while reducing open interest indicates a bear trend.

* The role of open interest in commercial strategies : Understanding open interest can help investors develop effective business strategies to profit from cryptocurrency. For example, traders relying on indicators such as Bollinger Bands or MacD can use open market sentiment interest rates and adjust their positions accordingly.

Trends in the crypto -market market and open interests

When the crypto -market market is constantly evolving, the trends in open interest are becoming increasingly important for both investors and traders. Here are some key observations:

* Increased activity in the established markets : When more investors enter the cryptomena market, open interest has increased significantly in established markets such as bitcoin.

* The emergence of a new cryptocurrency : The increase in new cryptomen has led to an increase in open interest, especially among those who invested in these assets. This increased activity can lead to higher prices and potentially more volatility.

Conclusion

An open interest is an essential concept to understand the world of investment of cryptocurrency. By analyzing open interest in futures trading, investors can get valuable information about the market sentiment and price movement. Although there are many factors in the cryptomen markets, there is a significant increase in open interest usually indicates bulls, while reduced open interest signals delay feelings.