Understanding and influencing trading indicators in the cryptocurrency -trade for decisions

The cryptocurrency trade has become increasingly popular over the years, and several investors are on online stock exchange exchanges to buy, sell, and trade digital currencies such as Bitcoin, Ethereum and others. However, navigating the world of cryptocurrency trade can be awesome, especially for beginners. One of the most important aspects that merchants need to understand is how trading indicators work and play a role in making founded decisions.

What are trading indicators?

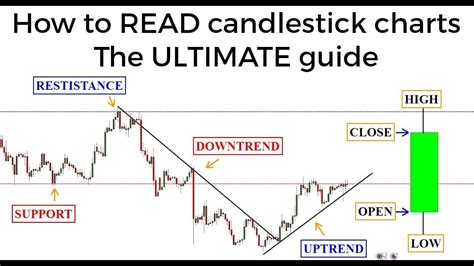

Trading indicators are graphic or numeric tools used to analyze market data and predict price movements. It is designed to help merchants identify trends, patterns and potential reversal. These indicators can be classified as two main types: technical and basic analysis.

Technical indicators

Technical indicators use mathematical formulas and calculations to predict future price movements based on historical market data. The most common type of technical indicator is the average (today) of the moving, which calculates the average price of safety for a specific period. Other popular technical indicators are as follows:

* The Relative Strength Index (RSI) : It measures the amount of recent price changes and gives you an idea of over -purchased or excessive conditions

* Bollinger Bars : A volatility index depicts three standard differences above and below the moving average, indicating possible outbreaks or reversals

* stochastic oscillator : measures the relationship between safety price and relative strength compared to its closing price with a 14 -day moving average

Basic indicators

Basic indicators, on the other hand, focus on economic and market data that influence the general direction of the market. These indicators are based on historical data and do not reflect future performance. Some popular basic indicators are as follows:

* Volume : Measure the number of shares sold during a given period

* Equity Get (EPS) : Provides insight into the company’s financial position and growth prospects

* The yield curve

: indicates changes in interest rates, affects market liquidity and asset prices

How do trading indicators affect decisions

Trading indicators play a decisive role in informing merchants’ decisions. By analyzing these tools, merchants can make more well -founded decisions on when to buy or sell based on historical data and trends. Here are some methods that trading indicators influence decision -making:

- Identification of trends : Technical indicators such as moving averages (MAS) and RSI help identify long -term trends in the market.

- Forecast for price movements : Basic indicators such as volume, EPS and yield curve provide insight into potential price movements based on historical data.

- Admission and exit points Set : By analyzing trading indicators, merchants can set clear entry and exit points to their trade, reducing the risk and maximizing possible yields.

- Management of the Risk : Technical indicators help merchants identify possible reversal or feedback, allowing them to change their position accordingly.

- Improve confidence : Trading indicators can increase the trader’s confidence in their investment decisions by giving accurate forecasts and signs.

Best exercises for using trading indicators

To get the most out of trading indicators, follow these best practices:

- Select indicators that are in line with the trading strategy

- Using multiple indicators to validate the analysis

- Adjust the wipe and exit points of the entry based on the signals

4.

5.