the rise of decentralized Finance (Defi) and the evolution of cryptocurrency: a guide to crypto, forks, pos, and risk-reward ratios

In recent years, cryptocurrency has experienced a meteoric rise in value, attracting investors and users from around the world. The decentralized Nature of Cryptocurrencies has led to a proliferation of new technologies and concepts, including forks, proof-of-stake (POS), and Risk-Reward ratios. In this article, we will explore the basics of each concept, as well as their roles in Shaping the Defi Ecosystem.

What is crypto?

Cryptocurrency is a digital or virtual currency that uses cryptography for Secure Financial Transactions. The most widely used cryptocurrency is Bitcoin (BTC), but many others are also available, including Ethereum (ETH) and Litecoin (LTC). Cryptocurrencies use advanced encryption algorithms to secure transactions and control the creation of new units.

The Fork Phenomenon

A fork in the blockchain referers to a change made to an existing cryptocurrency’s protocol that creates a new version with enhanced features or a different focus. Forks can be used to introduce Changes, Improve Security, or Create New Use Cases for the Cryptocurrency. For example, Bitcoin Cash (BCH) was created as a fork of the original Bitcoin (BTC) Blockchain.

Proof-of-Work (POS)

Proof-of-Work (POS) is a consensus algorithm that requires miners to solve complex mathematical puzzles to validate transactions on the blockchain. The first block to be solved by a miner is given the chance to add new blocks to the blockchain, and the reward for this is typically a certain number of tokens or other cryptocurrencies.

The Rise of Defi

Decentralized Finance (Defi) has emerged as a major force in the cryptocurrency space. Defi Platforms provide users with access to lending, borrowing, trading, and other financial services without the need for intermediaries like banks. Some popular Defi Protocols Include Makerdao, Compound, and Aave.

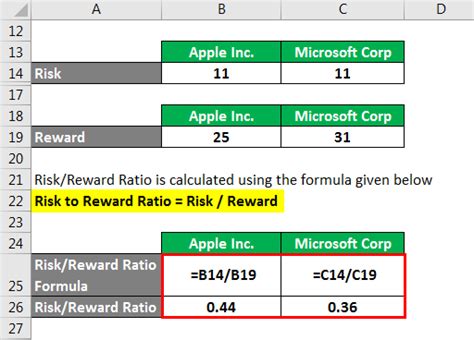

Risk-Reward Ratios

The risk-reward ratio referers to the relationship between the potential reward of a cryptocurrency investment and the level of risk involved. In cryptocurrency investing, it is essential to carefully evaluate the risks before committing funds to an investment. While some cryptocurrencies may offer higher requirements, they can also be highly volatile and prone to significant price drops.

Understanding Crypto Forks

Crypto forks have become increased common in recent years as more cryptocurrencies explore alternative consensus algorithms, such as proof-of-stake (POS). Some Notable Examples include Ethereum’s transition from a proof-of-work (POW) Blockchain to a proof-of-stake (POS) Blockchain and Monero’s Decision to Fork from the Bitcoin Blockchain.

POS vs. POW: What’s the difference?

Proof-of-Work (POW) is an energy-intensive consensus algorithm used by most cryptocurrencies, including Bitcoin (BTC). In contrast, proof-of-stake (POS) is a more energy-efficient consensus algorithm that rewards users with smaller tokens for validating transactions.

Comparison of Crypto Forks

HERE’S A COMPARISON brief of some popular Cryptocurrency Forks:

| | POW | POS |

| — | — | — |

|

Energy Consumption | High | Low |

|

Security | Robust | Vulnerable |

|

Use case | Traditional Blockchains | Smart contracts |

In Conclusion, Cryptocurrency is a rapidly evolving field with many new concepts and technologies emerging to the time. Understanding the basics of Crypto Forks, POS, and Risk-Reward ratios can help investors Make informed decisions about their investments. By staying up-to-date on the latest developments in these areas, you can navigate the complex world of cryptocurrencies with confidence.