Here is a Draft article on “crypto market correlation” with “bitmex”, “market sentiment”:

Title: “Navigating Crypto Market Volatility: Understanding Correlation and sentiment”

The Cryptocurrency Market Has Always Been Known for its High Liquuidity, Rapid Price Swings, and Unpredictable Nature. As the industry continues to grow and mature, understanding correlation and feeling is Becoming Increasedly Important for Investors, Traders, and Market Participants. In this article, We’ll delve into the concept of crypto market correlation and how it affects a sentiment market.

What is Crypto Market Correlation?

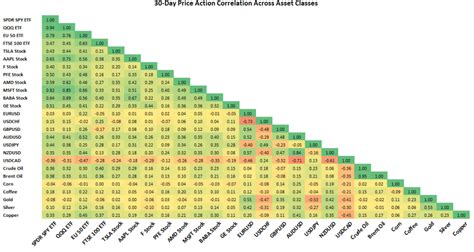

Crypto Market correlation refers to the degree to which different cryptocurrencies or markets moved together in Terms of Price Movements. It’s a Measure of How Closely Two Assets Are Tied, Often Used to Identify Potential Correlations between Different Assets. In The Context of Cryptocurrency Markets, Correlation Can Help Traders and Investors Understand WHETER IT.

How does crypto market correlation work?

Crypto Market Correlation Works by Analyzing the Relationship between Different Cryptocurrencies or Asset Classes about Time. By Examining Historical Price, Correlation Coeffici Are Calculated to Determine How Closely Each Pair of Assets Moves Together. For Example:

- Bitcoin (BTC) tends to move in Tandem with Other Altcoins Like Ethereum (ETH)

- The Cryptocurrency Index (CRI) Often Follow a Similar Pattern As The Overall Market

- Cryptocurrencies with Strong Fundamentals, Such as stablecoin-backed tokens, tend to exhibit low correlation

The Importance of Market sentiment

Market sentiment is a crucial in Understanding Crypto Market Correlation. Sentiment refers to the collective attitude or opinion among investors and traders about an asset’s potential performance. A Positive Feeling Can Lead to Increased Buying Pressure for A Cryptocurrency, While A Negative Feeling Can Result of Selling Pressure.

Understanding Crypto Market Correlation by Bitmex

Bitmex is one of the most well-known cryptocurrency exchanges, sacrificial liver and margin trading capacities. When it comes to correlation analysis on bitmex, traders can use varous tools to identify potential correlations between different assets. Some Popular Indicators Include:

- The stochastic oscillator: A Momentum Indicator That Helps Detect Oversold or Overbought Conditions

- The Relative Strength Index (RSI): A Momentum Indicator That Measures The Strength of Price Movements

- The Bollinger Bands: A Volatility Indicator That Helps Idelify Potential Breakouts

By analyzing thesis indicators and correlation coeffici, traders can gain insights into market dynamics and make more informed decisions.

REAL-WORLD Examples

- 2020 Cryptocurrency Market Correlation : Bitcoin (BTC) was heavy correled with ethereum (ETH), while other altcoins like solana (sol) and cardano (ada) tended to move separatily.

- Bitcoin and Altcoin sentiment

: In 2017, the sentiment around bitcoin Improved Significantly As More Institutional Investors Entered the Market, Leading to Increased Buying Pressure for BTC and A Subquent Price Surge.

Conclusion

In Conclusion, crypto market correlation is an essential concept for traders and investors to understand when navigating the high-volatility cryptocurrency markets. By analyzing correlation coefficients and marketing indicators, traders can gain insights into potential correlations between different assets and make more informed decisions about their investments.

By mastering this aspect of cryptocurrency markets, traders can Better Navigate the complex landscape of crypto trading and increase their chans of success in Today’s fast-paced market environment.